|

As Egyptians, we've got some things that we overspend on.

#1. Weddings

It makes sense that this is #1. Have you seen our weddings?

Egyptians celebrate weddings to an extravagant extent that one can pause and wonder how the couple continues to live the rest of their lives. Seriously though. The money is wasted on ONE DAY, which doesn't even seem quite responsible. It makes more sense that a wedding is celebrated modestly to quit the overspending. #2. Vacations

When it comes to traveling, travel agencies have just started to enter the scene with online advertising and a little of on-ground presence.

Yet, why are we quite behind in the acceptance of travel agencies? TRUST. yes. TRUST. It's quite common to find that most Egyptians don't trust travel agencies, think they're ripping them off or actually more expensive. When they really aren't, travel agencies provide packages at prices that they have managed to acquire by signing deals for a large number of people, which makes sense. Right? We're basically paying more when we decide to do this on our own. #3. Car Maintenance

Egyptian roads - what a delight. Once you purchase a car in Egypt, you know the day will come when you have to pay to fix it - no questions asked. You might even wake up and go to your car and there it is - demanding to be fixed.

However, how many of us actually have car insurance? I'm pretty sure once the car gets hit, the regret begins. Get insurance and save up a lot of money on car maintenance. #4. Ramadan Meals

Ramadan. The special time of the year where .. well the economy decides to start moving? Advertising kicks in so quickly. Every mall is crowded. Gatherings and large meals are a must. Other than that really isn't the point of Ramadan, expenses soar and for no legitimate reason. A lot of money can be saved and a lot of expenses can be avoided in Ramadan.

Wait a second...

0 Comments

You’re probably acutely aware of all the reasons you should boost your personal gratitude quotient.

**Hint:** Because it can help you get happier, healthier, less stressed-out—and more optimistic overall. Another big-time benefit? **Feeling grateful can also make you richer.**

You can do too little when planning for retirement. Yet most of the advice is focused on one thing: accumulating as much money as possible.

While that’s not a bad idea, you also have to pay attention to spending and lifestyle. A few key moves can make a big difference:

Money Talks Summit believes that sometimes to truly learn, all you need is a little inspiration.

Meet Christine Romans, the CNN chief business correspondent and cohost of the network’s “Early Start” is a veteran business journalist who reported for Reuters and Knight-Ridder Financial News before beginning her tenure at CNN covering the opening bell at the New York Stock Exchange.

Are Your Aging Parents Less Financially Savvy Than A High School Dropout?

It’s hardly surprising that mental ability, including financial know-how, declines with age. Yet a new study finds that accredited investors in their 80s are not only likelier to be less financially literate then their counterparts just a few years younger, but even of high school dropouts. In other words, once well-to-do investors get into their twilight years, their financial smarts drop off considerably!

Of all of the things you own, what’s your most valuable asset?

Your home? Your vehicles? Your retirement portfolio? If you answered yes to any of the above, in most cases you’d be wrong. Human capital — your ability to earn money now and in the future — is your most valuable asset. But most people ignore this fact and get distracted. Your net worth is largely above your shoulders - in your head!

Many investors still rely on their investment advisors to provide guidance and to help them manage their portfolios. The advice they receive is as varied as the background, knowledge and experience of their advisors. Some of it is good, some of it is bad, and some is just plain ugly.

Setting money aside for tough times is tougher to do than you might think.

If you lose your job tomorrow, do you have enough money to pay your rent next month? Bad things can happen. Start an emergency fund in three simple steps to cushion you in times of trouble.

Amazingly, the single biggest skill that can make or break your financial success isn’t taught in school. You can graduate with a four year degree and learn nothing about personal finance or investing.

Doctors and attorneys can open their own practices without any clue how to read a financial statement. Business owners and investors can remain dangerously ignorant of the tax law.

The truth is, financial literacy is the essential skill you must develop if your goal is to build wealth and enjoy financial security. There’s no alternative. The best investment you can make is in yourself and your financial education. It’s the obvious starting point to building wealth.

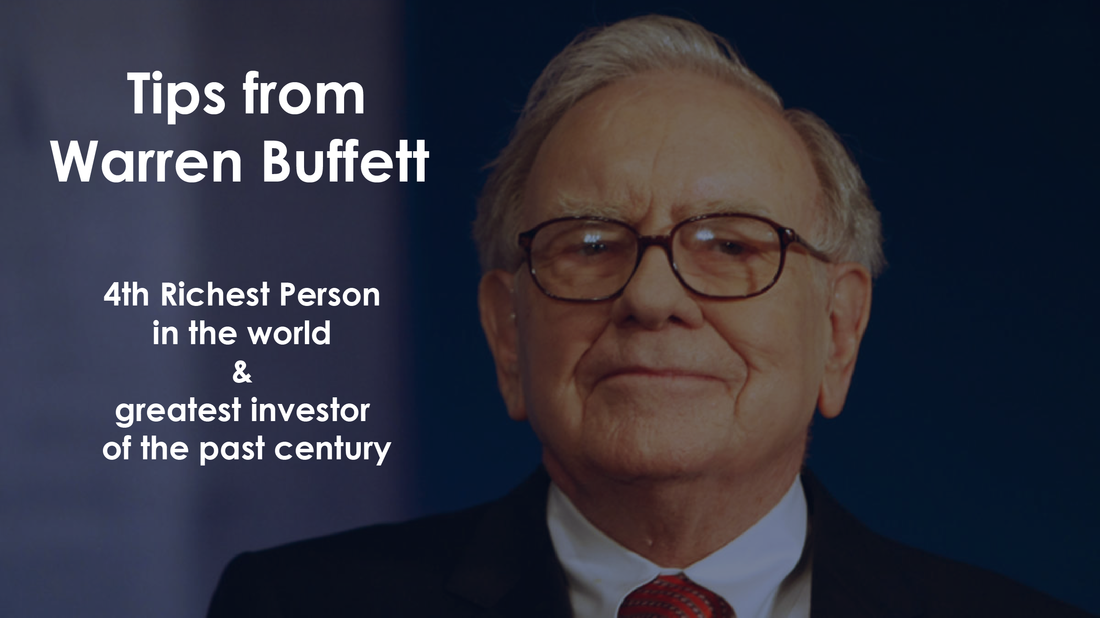

Warren Buffett, the fourth richest person in the world and the man widely thought to be the greatest investor of the past century, celebrates his birthday Aug. 30.

Buffett's interest in moneymaking began early. As a boy growing up in Omaha, Neb., he would sell chewing gum and magazines door to door, and he filed his first tax return at age 14 (marking deductions for his bicycle and watch, used on a paper route). In high school, Buffett and a friend bought a pinball machine and put in a local barber shop; they quickly expanded that enterprise to include several pinball machines around town. As well regarded for his folksy wisdom as his monetary acumen, Mr. Buffett has been regaling investors with helpful nuggets of advice for decades. Here are some of Warren Buffet's best investment tips (but be forewarned: the Oracle of Omaha doesn't give out stock picks). |

AboutMoney Talks Summit has money & budget solutions that are simple, intuitive, and help you get on track. Archives

September 2015

Categories |

|

Have questions? Call us at +201011055100

|

Organised By

|

|

© 2016 • Money Talks Summit • Cairo, 5-6 NOVEMBER 2016

|

RSS Feed

RSS Feed